Taking the risk out of security

A respected regional security company was known for helping its customers reduce their risks of theft or fire. With a branded fleet visible in the communities they served, the risks their field installers took while driving was undermining their reputation and costing the business money.

Challenge

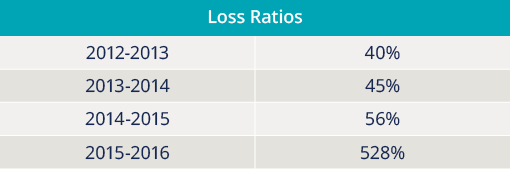

Between the years of 2012 and 2016, the Company was seeing an alarming increase in vehicle accidents, much of which was caused by distracted driving. The loss ratios on the automobile portion of their insurance (the ratio between insurance premiums paid and insurance claims paid) were skyrocketing as well, making them an unattractive risk for insurance carriers. By 2015, their incumbent carrier had notified them of their intent not to renew coverage.

Solution

Consolidated Insurance offered a solution to the Company that would enable them to not only ensure continued coverage but also improve the safety and profitability of their business. If the Company agreed to deploy TRUCE® Software across their entire field operations and introduce new safety-centric training and management guidelines, Consolidated believed they would be able to find a carrier to edit terms and conditions acceptable to the Company.

Results

In 2016, the Company deployed TRUCE across their workforce and Consolidated negotiated coverage with a new carrier. Since that time, the Company has had ZERO automobile claims. Their risk profile also resulted in successive 25% reductions in premiums two years in a row from their insurance carrier.

“When we tell the story to our underwriters of how our clients are better positioned than the next risk, the underwriters respond with more favorable terms and conditions.”

Brian Villari

Risk Advisor, Consolidated Insurance